Mar 11, 2025

A guardianship application involves applying to the court to be appointed as an incapable person’s substitute decision maker for property management and/or personal care decisions.

When a party applies to the court to be named a guardian, this usually means that the incapable party did not have a power of attorney in place. The process can be stressful and regularly arises when family members realize they need to begin making financial decisions for the incapable party but are unable to do so without a power of attorney for property in place.

To complicate matters further, applicants seeking to be a loved one’s guardian of property are regularly required to obtain expensive bonds as security to ensure the safety of the incapable party’s assets.

The judge hearing the guardianship application will determine whether or not it is appropriate to forgo the requirement that a guardian obtain a bond (see: Grant v Robinson, 2024 ONSC 1558 and Connolly v. Connolly and PGT, 2019 ONSC 4148).

It is important to discuss with a lawyer the information a judge will need to determine whether a bond is necessary in the case at hand. Every situation is different, but it is often helpful to provide evidence on the following:

- The proposed guardian’s relationship to the incapable party. For example, a court may be less inclined to order that the spouse of an incapable party obtain a bond, especially where assets have always been jointly held between the proposed guardian and the incapable party.

- Whether the proposed guardian resides in and has assets in Ontario that could be used to repay the incapable party in the event funds are mismanaged or misappropriated.

- Information on the incapable party’s assets and the funds required to meet the incapable party’s care needs.

- Information on the estimated cost of a bond and whether the cost will be burdensome for the incapable party or is disproportionate to their assets.

- Whether the incapable party has made any specific gifts in their will.

- The proposed guardian’s intention to continue relationships with or retain professionals such as accountants and financial advisors to provide advice on investment strategy and the incapable party’s financial obligations.

- A plan to seek an order that the proposed guardian shall bring an application within two to three years to “pass their accounts”. A passing of accounts application requires the guardian to show the court all transactions related to the incapable party’s funds during the accounting period. The need for a bond can be reassessed on each passing application.

- A clear, common sense management plan that shows how the proposed guardian intends to manage the incapable party’s funds.

Overall, when bringing a guardianship application, it is critical to provide evidence on the proposed guardian’s honesty, integrity and their dedication to acting in the incapable party’s best interest. These factors and the specific examples above may militate against a finding that a bond is necessary.

Rebecca Suggitt

Nothing contained in this post constitutes legal advice or establishes a solicitor-client relationship. If you have any questions regarding your legal rights or legal obligations, you should consult a lawyer.

Feb 20, 2025

On February 6, 2025, Cara Zacks was a panelist at the Ontario Legal Conference hosted by the Ontario Bar Association. Cara Spoke on a panel with family law lawyer Kelly Jordan on the subject of Marital Contracts After Death. The Panel was moderated by family law lawyer Ibtisam Jemal.

Cara presented on issues related to the enforceability of a marriage contract after death. In particular, she discussed setting aside provisions in a marriage contract through which a spouse releases the right to claim dependent support under the Succession Law Reform Act or to elect equalization after the death of a spouse.

Nothing contained in this post constitutes legal advice or establishes a solicitor-client relationship. If you have any questions regarding your legal rights or legal obligations, you should consult a lawyer.

Feb 14, 2025

Are you investigating property ownership or searching for uncovered claims, liens or encumbrances in Ontario? The province’s land registration services are ONLY available online through ONLAND. ONLAND is the official portal for land records, allowing you to search by Property Identification Number (PIN), address, instrument, or map. But what if you don’t have the PIN or no records linked to the address can be found in the system? Here’s how you can still proceed.

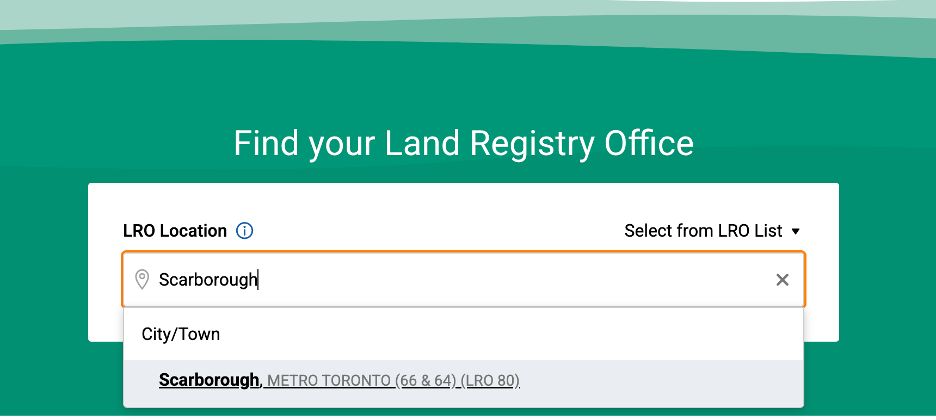

Step One: Identify the Land Registry Office (LRO) Number

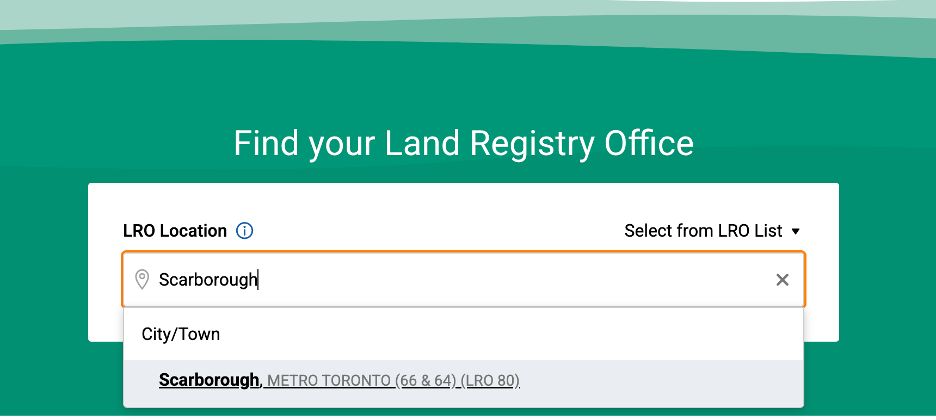

Your first step is to determine the correct LRO number. Enter the city or town name in the search bar on the ONLAND portal. The corresponding LRO location and number will be displayed. For example, tying “Scarborough” will show “Metro Toronto” with LRO number 80.

Step Two: Access Property Information

Once the LRO is identified, access the “Search” option under “Property” section, which allows you to search by PIN, address, instrument or map.

If you don’t have the PIN, you can still conduct searches by address or map feature.

Search By Address

This can be done by entering the municipal address (mailing address) of the property. Please note that you should enter only the street name, without additional identifiers. For example, for “Adelaide St E”, enter “Adelaide” only.

However, some properties may not be linked to a municipal address in the system. This is especially common for properties like farmland and cottages. If your search yields no records, don’t give up – you can switch to a map-based search to continue.

Tip: Search Neighbouring Properties for PIN Information

If the address search doesn’t work, one helpful tip is to search other street numbers under the same street name. If a neighbouring property is linked to its municipal address, you can identify the first five digits of the PIN, which is the same for all properties in the general block. This information can help you narrow down your search to the correct area when using the map feature.

Search By Map

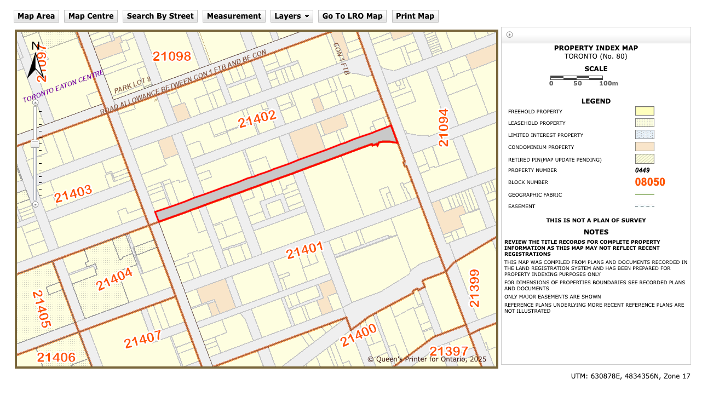

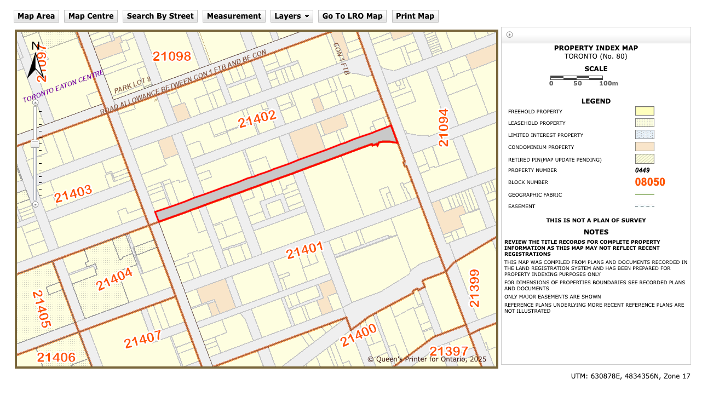

By selecting “Map”, ONLAND will display Ontario Electronic Property Index Maps (“ONLAND Maps”), showing all the properties in the area. Make sure you are viewing the correct LRO map and turn on the “geographic information” as references to assist with identifying the property‘s location.

Identify the Block by Using “Search by Street”

To further narrow down your search, use the “Search by Street” feature. Enter the street name without any indicators. For example, searching for “Adelaide” will display a list of all the streets containing “Adelaide”. From there, you can sort through the options and select the correct street. Once the correct street is selected, browse the map to find your block and the relevant properties.

For example, in the screenshot below, I can identify the “Adelaide” street between block number 21402 and 21401.

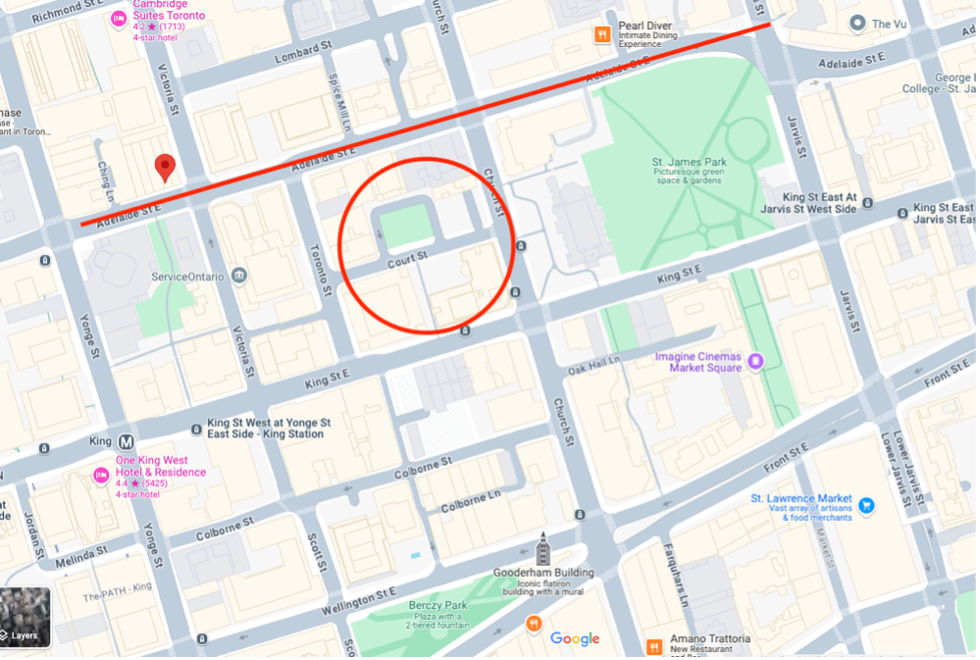

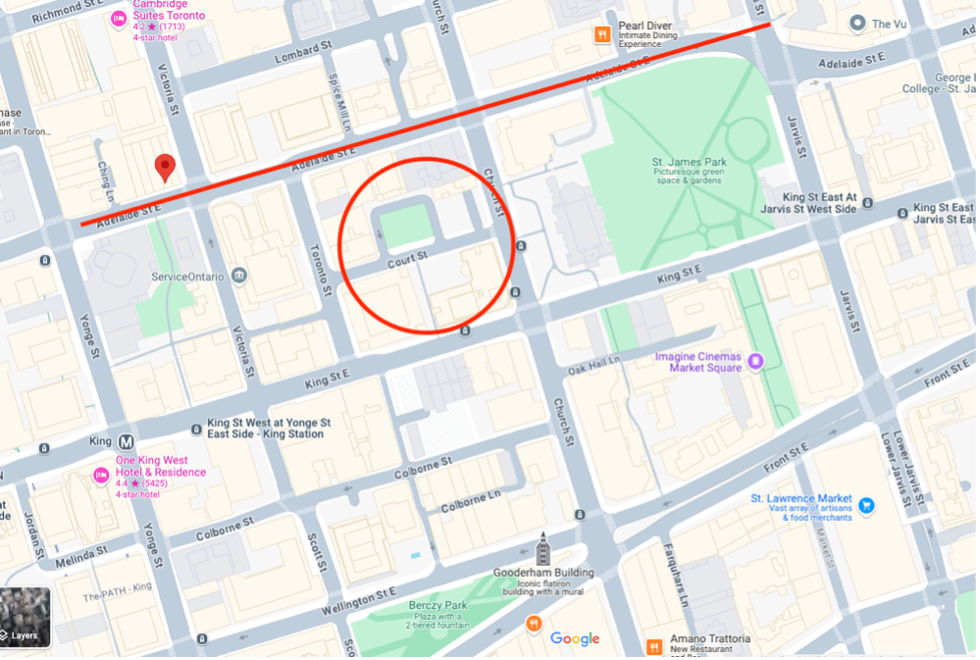

Identify the Property by Using Google Map

Another helpful method is to use Google Maps to familiarize yourself with the property’s surroundings and identify any notable landmarks features.

For instance, searching for “20 Adelaide Street E” in Google Maps will show the building’s position relative to roads and landmarks. You can then compare Google Maps to the ONLAND Maps to confirm the correct property. (See two screenshots below where you can identify the property by matching the distinguishable street features between Google Maps and ONLAND Maps.)

Identifiable features such as lakes, dead-end streets, or corners can also help you locate farmland or cottage properties.

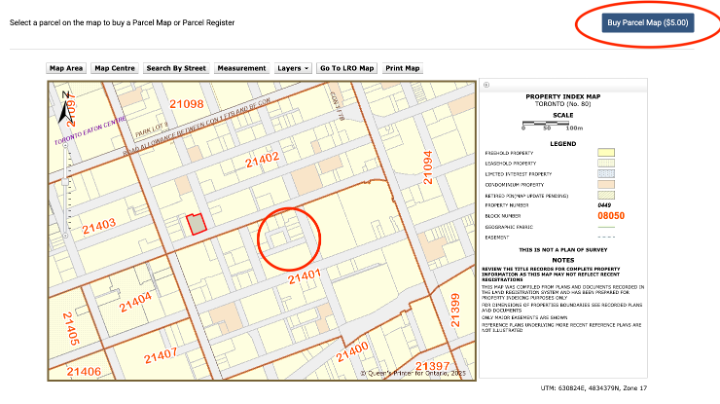

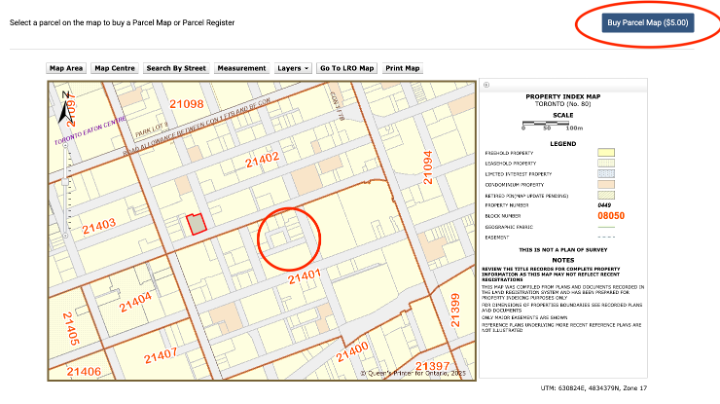

Step Three: Purchase the Parcel Register

Once you’ve located the correct property on the ONLAND Maps, select “Buy Parcel Map”. After paying the $5 fee, the assigned PIN for the selected property will be displayed, allowing you to then purchase the parcel register.

This parcel register will provide detailed ownership and encumbrance information for the property. In my next blog, we will explore how to interpret parcel register data and how to search by instrument.

Jennifer Jiang

Nothing contained in this post constitutes legal advice or establishes a solicitor-client relationship. If you have any questions regarding your legal rights or legal obligations, you should consult a lawyer.

Jan 23, 2025

In the winter of 2023, I had just finished my honours bachelor’s degree at the University of Toronto and was ready to launch forward into adulthood. As a 22-year-old, I found the working world quite daunting, so the thought of having real ‘adult job’ was intimidating. Come the new year, I decided to put myself out there and apply to a variety of positions – one of which was a legal assistant at Casey and Moss.

While reading the C&M website, I was thoroughly impressed by the work the firm had done and their prestigious recognition among estate lawyers. I resonated with their mission to provide excellent service to clients, and their emphasis on providing flexibility to their employees. Next thing I knew, I was interviewing and had secured my position as a legal assistant!

I began as an assistant to Angela Casey and Angelique Moss, both of whom provided a warm welcome and an open-door policy. I’ll admit that the first month in this position was especially challenging as I was unfamiliar with estate law and the responsibilities of a legal assistant. Thankfully, my colleagues provided me with a space where I felt comfortable asking questions and, over time, I was able to build skill and confidence.

Once I was more settled, I was given the opportunity to work on projects more independently. In addition to secretarial work, Angela and Angelique had me assist in preparing pleadings. This was when I was really given the chance to see estate law in practice and understand what is required when engaging with estate litigation, guardianship, and other matters. I did (and still do) very much enjoy doing this work alongside Angela and Angelique.

After months of hard work, dedication and continued learning, I was offered a position as Rebecca Suggitt’s legal assistant. While I was initially worried about assisting three lawyers and the increased workload, I now couldn’t be happier to work alongside these three wonderful lawyers. They have taught me essential lessons not only in estate law, but also in life. Importantly, they helped me to see the value in trial and error and helped me realize when I was being too hard on myself (I’ll never pass on one of Rebecca’s pep talks!).

The most recent addition to my responsibilities has been assisting Angela with an ETDL file (“Estate Trustee During Litigation”). As a legal assistant, working on an ETDL file requires constant monitoring and communication with counsel. Accordingly, I was able to develop my multitasking skills and learn to better prioritize tasks. Though it can be challenging at times, I am especially grateful for the opportunity to work on this type of file because I’ve been able to do more independent work and exercise initiative.

Working at Casey and Moss continues to be an invaluable experience. As I come up on one full year with this firm, I reflect on my development as both a Casey and Moss employee and as a person. Without this team, I would not be where I am or who I am today.

I look forward to another year in my career journey with Casey and Moss!

Hannah Henley

Nothing contained in this post constitutes legal advice or establishes a solicitor-client relationship. If you have any questions regarding your legal rights or legal obligations, you should consult a lawyer.